Bubble or growth? Photo courtesy Joshua Rothhaas

As some of you may know, I’m selling my home at Mueller, and moving into another new home here in the ‘hood. While I’m busy patting myself on the back for getting pre-construction pricing on a new yard home, I’m also thinking about the thoughts going through my mind in the appraisal process for my current home, and it led me to the question: Is it time to get out while the going is good?

I ordered an appraisal for my home about a week ago, and an appraiser came over on Monday to check out my house. I did my best to prepare for his visit – I can tell you more about how to prepare for appraisal if you’re interested – just leave a comment or go to the contact a Mueller Realtor page. And I found myself reasoning about waiting a few more days for a pending sale to close. It has closed now, and shows a different story to that of a week ago.

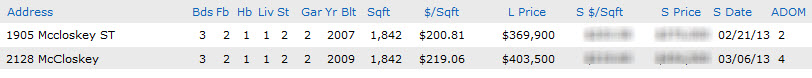

Here’s why. One home on my street was listed at $369,000 on 1/15/2013 – a nicely presented home on a corner lot. Fifteen days later, the same floor plan home was listed at $403,500 on 1/31/2013 on an interior lot. There were some differences in age and interior details for sure, but it’s hard to believe that the first home wasn’t sold at below market value (I have greyed out the sold prices as there are Texas Real Estate Commission rules about what I can share publicly) That said, I would still prefer to have used the second home as a comparable for my appraisal.

Homes rising 9% in 2 weeks??

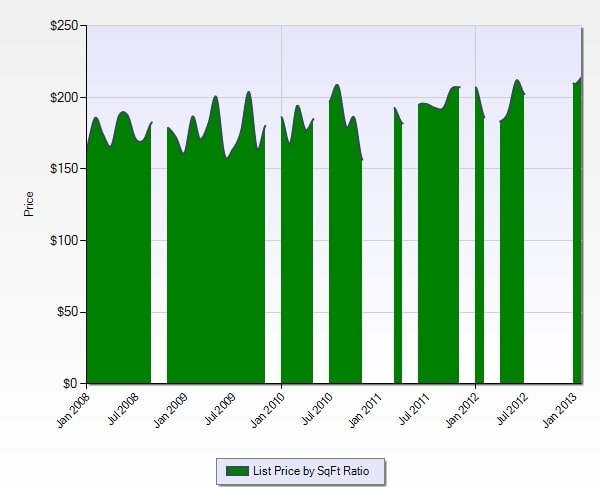

Which got me to thinking. If I’m hoping for ever escalating appraisal values, each being based on the previous sale, doesn’t that sound like the inflation of a bubble? It’s like saying, “each home sells for x% more than the last”, which sounds fine in an accelerating extreme sellers’ market in an extremely desirable neighborhood in the middle of a city where pretty much the same thing is happening to some extent all over. But at what point does this create instability? Are prices going to continue to escalate, and when is a good time to sell?

Limited data in the $500k Mueller MLS sales showing just how little inventory there is

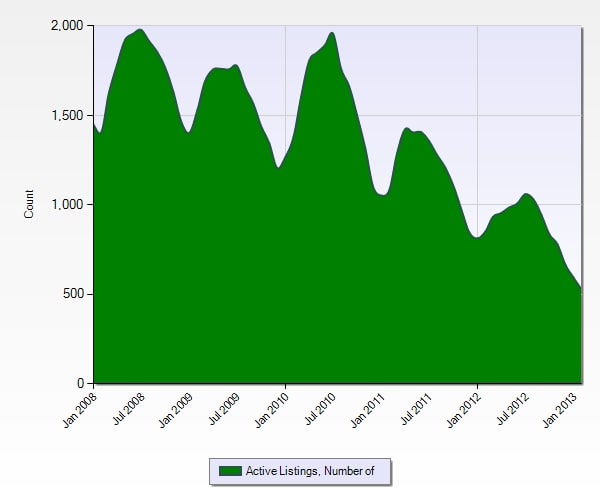

My belief is that prices are going to continue to rise, so if “when should I sell?” is a question burning you up inside, the answer is based on circumstances, where you are thinking of buying, and what interest rates are doing. The analytical / cynical side of my brain tells me that most of us are buying a mortgage and using a living solution as collateral. Mortgages are cheap right now. (The other side of my brain is telling me that people are buying a lifestyle, and ignores all the thoughts about mortgages and market dynamics.)

The story in the City of Austin is the same – low, low inventory in the same price point

Is there a bubble? I don’t think so – given the impending new amenities here in Mueller, and the controlled way in which new homes are being added. It’s hard to predict what is going to happen to house prices, and it’s tempting to think they’ll keep appreciating. My guess is that they will do for 2013.

Should you get out while the going is good? It’s certainly a good time to be a seller, and sensible agents are pricing where the market is heading (up!) , and if you need any help talking through your options as a buyer or a seller, give me a call – 512 215 4785